Understanding the HS Code for Pleated Filter Cartridges in Global Trade

Harmonized System (HS) Code Basics for Pleated Filter Cartridges

The Harmonized System (HS) Code is an internationally recognized system used to classify goods in global trade. Each product is assigned a unique code that helps customs authorities identify and track goods as they move across borders. For businesses involved in the import and export of goods, understanding the HS Code is essential for compliance with trade regulations and tariffs.

When it comes to pleated filter cartridges, a common product used in various industries for filtration purposes, having the correct HS Code is crucial. The HS Code for pleated filter cartridges falls under Chapter 84 of the Harmonized System, which covers machinery and mechanical appliances. Specifically, pleated filter cartridges are classified under HS Code 8421.99.

This code is further broken down into subcategories based on the specific characteristics of the product. For pleated filter cartridges, the subcategories may include factors such as the material of construction, size, and filtration efficiency. It is important for businesses to accurately determine the correct subcategory to ensure proper classification and compliance with trade regulations.

One of the key benefits of using the HS Code system is its universal application. The same code is used by customs authorities in over 200 countries, making it easier for businesses to navigate the complexities of international trade. By correctly classifying pleated filter cartridges under the appropriate HS Code, businesses can avoid delays in customs clearance and potential penalties for misclassification.

In addition to facilitating trade, the HS Code also plays a crucial role in determining the applicable tariffs and duties for imported goods. Each HS Code is associated with a specific tariff rate, which is used to calculate the amount of duty owed on the imported product. By accurately classifying pleated filter cartridges under the correct HS Code, businesses can ensure they are paying the correct amount of duty and avoid any potential disputes with customs authorities.

To determine the correct HS Code for pleated filter cartridges, businesses should refer to the Harmonized System database, which provides detailed information on the classification of goods. It is important to carefully review the descriptions and guidelines provided in the database to ensure accurate classification. In cases where there is uncertainty or ambiguity, businesses may seek guidance from customs brokers or trade consultants with expertise in HS Code classification.

In conclusion, understanding the HS Code for pleated filter cartridges is essential for businesses engaged in global trade. By correctly classifying these products under the appropriate HS Code, businesses can ensure compliance with trade regulations, avoid delays in customs clearance, and accurately calculate the amount of duty owed on imported goods. With the universal application of the HS Code system, businesses can navigate the complexities of international trade with confidence and efficiency.

Importance of Correctly Classifying Pleated Filter Cartridges under HS Code

In the world of global trade, correctly classifying products under the Harmonized System (HS) Code is crucial for ensuring smooth customs clearance and compliance with international trade regulations. One product that often requires careful classification is pleated filter cartridges, which are commonly used in various industries for filtration purposes. Understanding the HS Code for pleated filter cartridges is essential for importers and exporters to avoid potential delays, penalties, or disputes with customs authorities.

The HS Code is a standardized system used to classify products for customs and trade purposes. It consists of a six-digit code that is universally recognized and used by most countries around the world. Each product is assigned a specific HS Code based on its characteristics, composition, and intended use. The correct classification of products under the HS Code is essential for determining the applicable tariffs, duties, and regulations that apply to the import or export of goods.

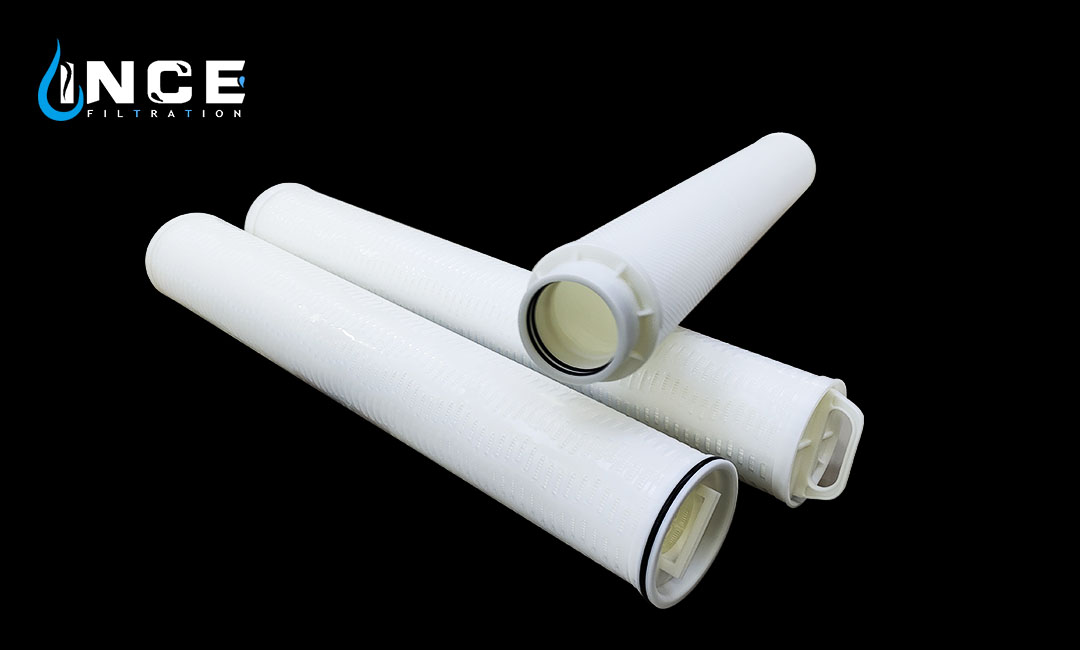

Pleated filter cartridges are commonly used in industries such as water treatment, pharmaceuticals, food and beverage, and automotive. These cartridges are designed to remove impurities, contaminants, and particles from liquids or gases, ensuring the quality and purity of the final product. Due to their widespread use and importance in various industries, pleated filter cartridges are subject to specific regulations and requirements when it comes to customs classification.

When classifying pleated filter cartridges under the HS Code, importers and exporters must consider various factors such as the material composition, size, shape, and intended use of the product. The correct classification of pleated filter cartridges is crucial for determining the applicable tariffs, duties, and regulations that apply to the import or export of these products. Incorrect classification can lead to delays in customs clearance, additional costs, or even legal issues.

Pleated filter cartridges are typically classified under HS Code 8421.99, which covers other filtering or purifying machinery and apparatus for liquids or gases. This code is used for various types of filtration equipment, including filter cartridges, filter bags, and filter housings. However, within this category, there are specific subcategories and classifications that may apply to pleated filter cartridges based on their design, material composition, and intended use.

To ensure the correct classification of pleated filter cartridges under the HS Code, importers and exporters should consult with customs authorities, trade experts, or industry associations for guidance. It is essential to provide accurate and detailed information about the product, including technical specifications, material composition, and intended use, to facilitate the classification process. By correctly classifying pleated filter cartridges under the HS Code, importers and exporters can avoid potential disputes with customs authorities and ensure compliance with international trade regulations.

In conclusion, understanding the HS Code for pleated filter cartridges is essential for importers and exporters to navigate the complexities of global trade and customs regulations. By correctly classifying these products under the appropriate HS Code, businesses can ensure smooth customs clearance, avoid potential delays or penalties, and comply with international trade requirements. Proper classification of pleated filter cartridges is crucial for maintaining the integrity of the supply chain and facilitating the efficient movement of goods across borders.

Common Mistakes to Avoid When Using HS Code for Pleated Filter Cartridges in Global Trade

When it comes to global trade, understanding the Harmonized System (HS) code for your products is crucial. The HS code is a standardized system used to classify goods for customs purposes. Each product is assigned a unique code that helps customs authorities identify and track goods as they move across borders. For businesses involved in the trade of pleated filter cartridges, using the correct HS code is essential to ensure smooth customs clearance and compliance with international trade regulations.

One common mistake that businesses make when using the HS code for pleated filter cartridges is assigning the wrong code. The HS code for pleated filter cartridges is 8421.99.00. This code specifically identifies filtration or purification equipment for liquids, whether or not it is fitted with a filter. It is important to use the correct HS code to avoid delays in customs clearance and potential penalties for misclassification.

Another mistake to avoid is using a generic or broad HS code that does not accurately describe the product. Using a generic code can lead to confusion and potential issues with customs authorities. It is important to be specific and use the most accurate HS code for pleated filter cartridges to ensure proper classification and compliance with trade regulations.

Additionally, businesses should be aware of any additional duties or taxes that may apply to pleated filter cartridges. Some countries impose specific tariffs on certain products, including filtration equipment. It is important to research and understand the tariff rates for pleated filter cartridges in the countries where you are exporting or importing goods to avoid unexpected costs.

Furthermore, businesses should be mindful of any restrictions or regulations that may apply to pleated filter cartridges in certain countries. Some countries have specific requirements for the importation of filtration equipment, such as certification or testing requirements. It is important to be aware of these regulations and ensure compliance to avoid any issues with customs authorities.

In conclusion, understanding the HS code for pleated filter cartridges is essential for businesses involved in global trade. By using the correct HS code, businesses can ensure smooth customs clearance and compliance with international trade regulations. It is important to avoid common mistakes such as assigning the wrong code, using a generic code, or overlooking additional duties and regulations. By being informed and proactive, businesses can navigate the complexities of global trade and successfully import or export pleated filter cartridges to international markets.